Travelling is worthwhile. However, while we hope for the best, it is wise to prepare for the worst. This is why travel insurance is as important as the trip itself. “If you cannot afford travel insurance, then you cannot afford to travel”.

If something happens to you while traveling abroad, who would be contacted? In the case of death, what would your family do? Does travel insurance cover the repatriation of bodies back to the home country? These are all the questions I pondered on after I survived a terrible accident on a road trip from Tirana, Albania to Ohrid, North Macedonia.

Given the pandemic, I didn’t neglect to buy travel insurance on this trip. I specifically asked my insurer if the insurance would cover medical expenses if I had covid-19. Once I got an assurance that it would, I proceeded to purchase one-year travel and medical insurance.

Here are reasons why you should not ignore buying travel insurance:

Getting medical care abroad or other personal liabilities can be very expensive; especially when such expense was not budgeted for, which can ruin your entire trip. Travel insurance can cover these medical expenses and personal liabilities such as trip cancellation, repatriation costs, compensation for in-flight loss of checked-in baggage, loss of travel documents, and other travel emergencies. Buying a good travel insurance cover means you worry less about such emergencies.

Most countries make it mandatory while others do not. Schengen Countries require all applicants to obtain travel insurance issued by an accredited Schengen Insurance Policy Company, which should be valid in all Schengen Countries and cover expenses caused by illness, medical care, and accident… up to the sum of 30,000 Euros before a visa can be issued.

Things to note:

- Before you purchase insurance, opt for an insurance company with good customer service and round-the-clock accessibility in case of emergencies. You do not want to be stranded abroad with little or no access to your insurer.

- Compare different insurance providers and check reviews from their customers. Ask relevant questions. It is important to disclose to your provider whether you have a pre-existing medical condition, so you can get advice on optional coverage as most insurance policies may not cover pre-existing medical conditions.

- If you are taking more than two holidays in a year, annual multi-trip insurance could save you money rather than purchasing single trip insurance which would be valid for the duration of each trip. I purchased one-year insurance this time because it was a cheaper option than limiting myself to 3 months.

- Insurance policies have specific benefits and exclusion clauses; you must review your insurance plan thoroughly before you buy, read the wording carefully, and ask questions when in doubt.

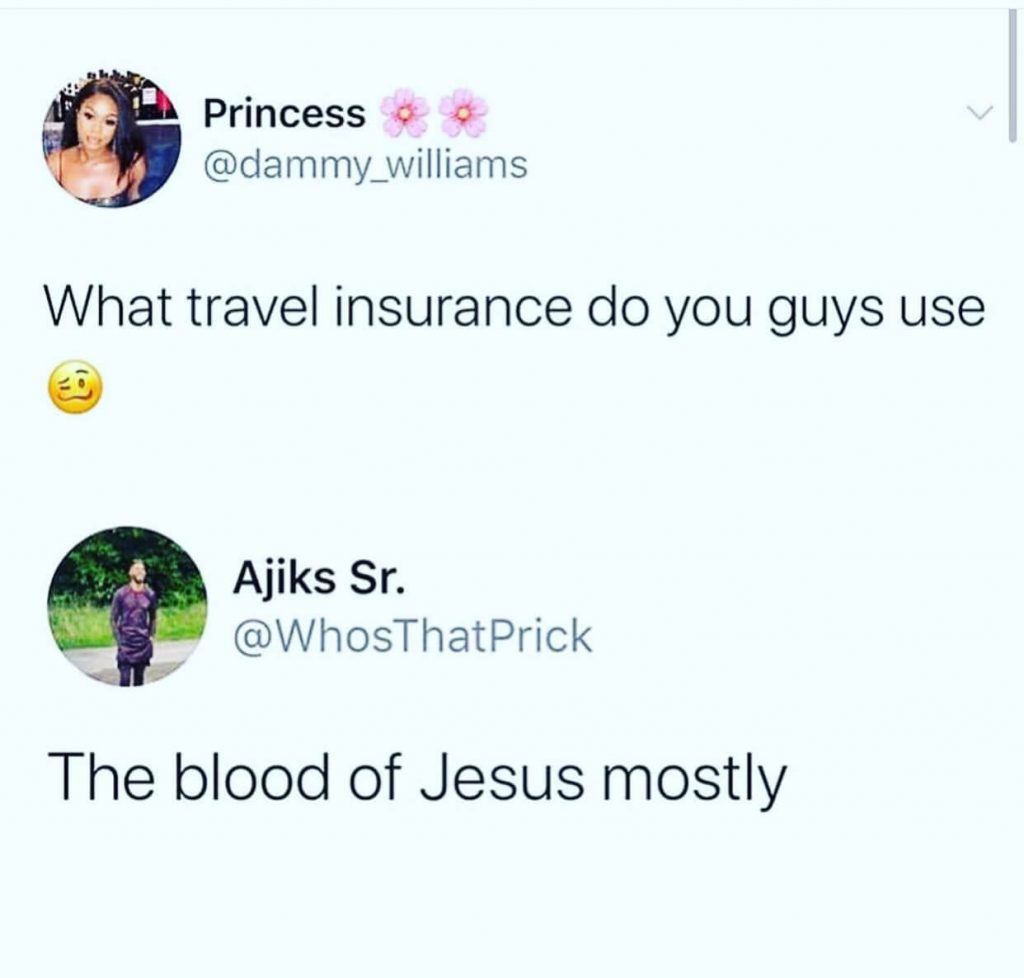

Do you purchase travel insurance when you travel or do you rely mostly on the Blood of Jesus?

I Survived a Terrible Road Accident While Travelling From Albania to North Macedonia

I am an avid traveler and this is an eye opener. I have never procure travel insurance. I do not trust insurance companies.